FINANCIAL SERVICES CUSTOMER EXPERIENCE SOFTWARE SOLUTIONS

Digital-First Engagement Across Banking, Credit and Asset Management

Account opening, onboarding and client servicing conversations made faster and simpler.

Request a DemoBanking Digital Transformation Demands an Omnichannel Approach to Customer Communications

In an age of disruption from fintech and other non-bank competitors, banking clients expect highly personalized, fast and easy digital interactions. So do financial advisors and employees.

Smart Communications helps you compete with an omnichannel customer experience that grows wallet share while reducing risks of non-compliance with financial regulators. We help your financial institution do more with less, reducing IT costs, improving agility and accelerating time to market.

Built to Scale Across Your Financial Services Enterprise

Do you have overlapping customer engagement IT solutions that you need to pay for, integrate and make work together? Learn how you can do more with less. Save time and money while reducing risk with a single cloud-based platform built to scale for today’s diversified financial services enterprise.

Retail and Commercial Banking

Smart Communications Recognized as a Leader in Financial Services Technology

Industry analysts and other experts have highlighted our leadership in both innovation and customer success across financial services. This recognition is just one reason why so many banks and other financial institutions continue to choose us as their trusted partner.

“Smart Communications continues to demonstrate its leadership and impact on the industry, as reflected in their placement on the 2024 IDC FinTech Rankings Top 100 and their remarkable year-over-year growth and recognition by IDC as a Fast Track FinTech."

– Marc DeCastro, Research Director, IDC Financial Insights

Industry-Leading Customer Communications Management for Banking

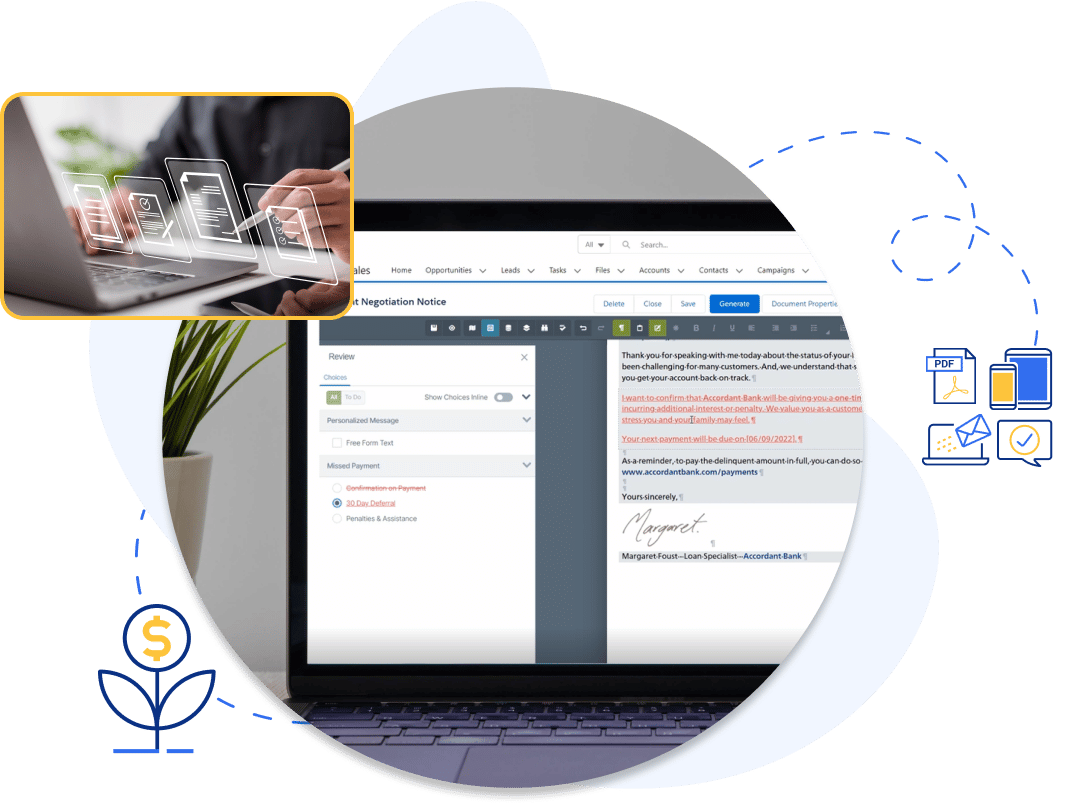

Loan agreements, disclosures, marketing offers, correspondence, statements, investment reports. Your communications represent “moments of truth” in the customer experience. The Conversation Cloud™ enables your business to manage and automatically produce the right message, document or document package at the right time – on demand to one customer, or in batch to millions – following compliance and brand rules.

Whether you want to deliver via web portals, email, SMS text, the contact center, the branch or advisor’s office, or even postal mail, find out how you can reduce template management and IT costs with a truly omnichannel communications solution that meets your tightest security needs.

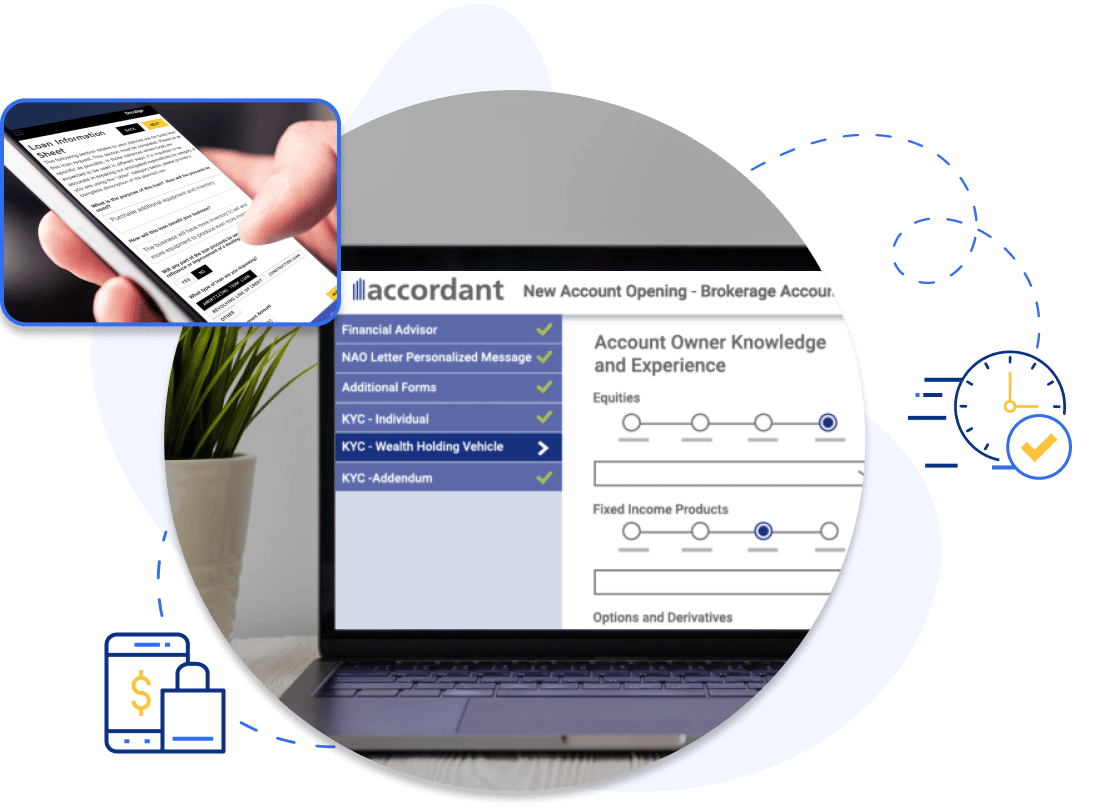

Enable Frictionless Financial Interactions with Digital Forms Transformation

Loan applications, onboarding and account servicing forms, investor subscription agreements. Digital transformation requires re-imagining traditional print forms, fillable PDFs or web forms like these.

With the Collect capability in the Conversation Cloud you can give customers and advisors a highly personalized, digital and mobile-friendly guided interview that reduces abandonment and error rates – especially key for complex transactions and processes.

Financial Services Use Cases Across the Customer Journey

Success in financial services means thinking about the customer journey from acquisition to servicing and back again. The Conversation Cloud provides a single enterprise platform flexible enough to support all of your critical agreements and communications – in every line of business.

Customer Acquisition

Customer Onboarding

Account Servicing

Customer Acquisition

Client Onboarding

Account Servicing

The Only Enterprise-Class, Scalable Customer Communications Management Solution Built for Salesforce

Watch how SmartCOMM™ for Salesforce enables financial institutions to create fully compliant and personalized documents and other customer communications, without ever leaving the Salesforce environment. Learn why banks and asset managers are moving away from basic document generation tools to modernize on our secure and highly scalable enterprise platform.

Financial Services Resources

Learn more about how the Conversation Cloud aligns with financial services industry trends and strategic priorities.

EBOOK

6 Ways to Change the Conversation in Lending

This eBook provides actionable strategies and tips to help you re-imagine the way you interact with borrowers and loan officers in the digital-first world.

Download eBookFinancial Industry Featured Customers

Our Featured Partners

Banks and financial institutions around the world trust Smart Communications, including all 15 of the world’s largest investment banks, 9 of the top 10 banks in Australia and 3 of the biggest credit card servicers, to name a few. Here are just some of them:

We partner with the best of the best to help you create seamless integration experiences for your financial services and banking customers and advisors.

Visit Partner NetworkExperience the Conversation Cloud

Designed to guide customers, advisors and partners through critical banking and other financial interactions with your organization.