DIGITAL WEALTH MANAGEMENT

Wealth and Financial Asset Management Solutions

Faster, friendlier, and compliant digital-first client engagement

Request a DemoSimplify Wealth Management Communications with One Platform

Providing seamless, personalized, and real-time digital wealth management experiences is key to retaining client loyalty and attracting younger investors, while also simplifying the work of financial advisors.

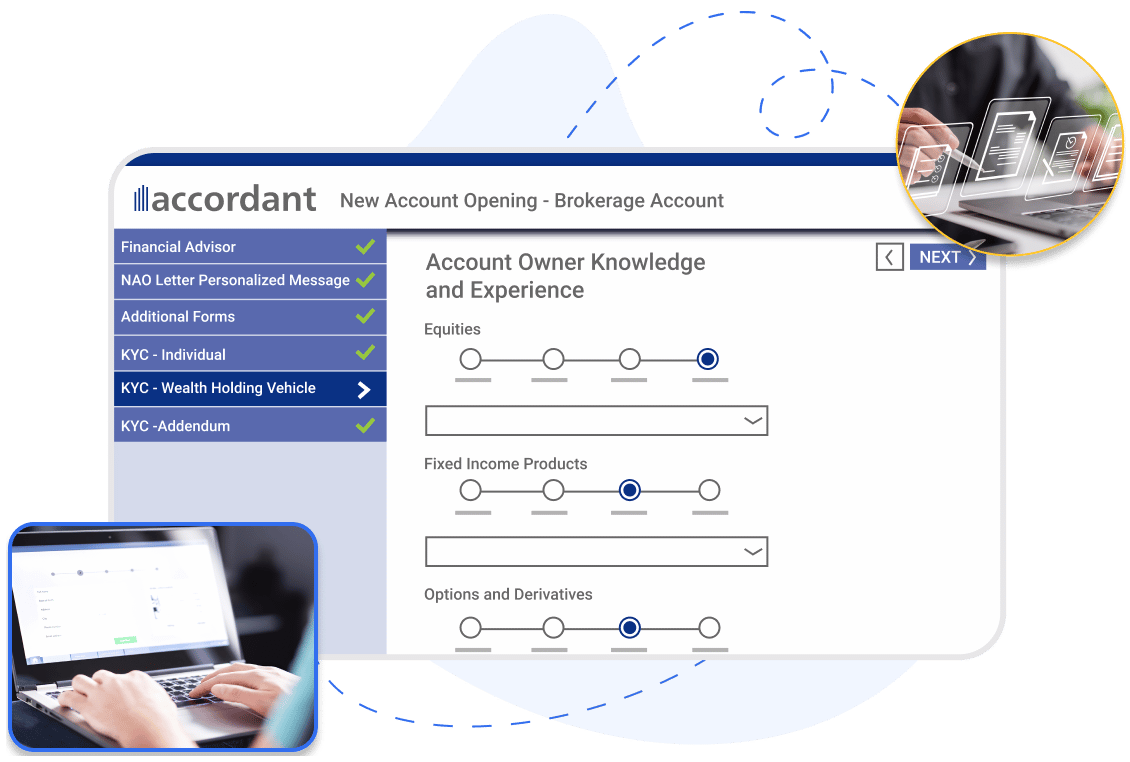

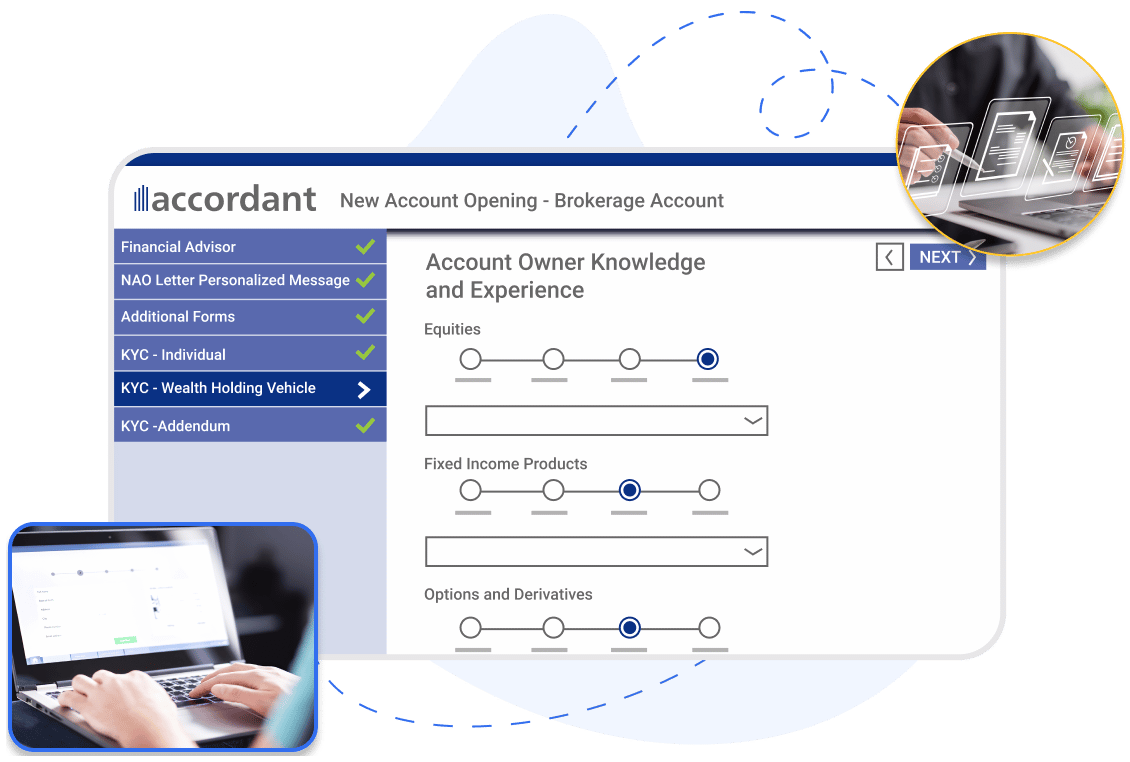

New Investment Account Opening

Digital disruption has raised expectations. Today’s clients expect to open new accounts in seconds, from anywhere, on any device. Through our collect capability, use intelligent, data-driven digital interviews to personalize the way you capture the data needed to open new accounts. Then produce compliant agreements for e-signing on demand. Fewer errors, more new business, good news for your top line.

Learn MoreClient Onboarding

Streamline and digitize client onboarding around automated forms processes and data capture. Create suitable investment proposals and other documentation to stay compliant with FINRA and other global regulation requirements. Onboard clients in minutes, not weeks.

Read Solution Brief

Hyper-Personalized, Compliant, Client Servicing Communications

Transform client servicing “moments of truth” into a real moment for your clients and relationship managers. Envision a new era of digital and mobile-assisted interviews for servicing forms, such as beneficiary updates. Deliver data-rich, graphical statements in bulk and tailor-made one-on-one client reports. Ensure every client message adheres to compliance standards and remains auditable across all communication channels. Discover how the Conversation Cloud™️ can elevate your back office efficiency while empowering financial advisors to enhance trust and foster lasting loyalty.

Request a DemoWealth Management Customers Achieve Real Results

Our clients worldwide have successfully transitioned to digital wealth management and provided compliant, personalized wealth management communications with the help of the Conversation Cloud. By utilizing our platform, they've seen positive returns on investment. Find out how we can help you achieve similar results.

Front Office

Operations

IT Executives

Compliance

Improved Experience for Clients and Advisors

From desktops to mobile devices and in-app messaging, deliver a seamless and highly personalized omnichannel experience.

Improved Efficiency and Productivity

Support straight-through processing for identity verification and other tasks.

Gain Flexibility and Scalability with Lower IT Costs

Empower business users to manage and update content and rules without IT involvement.

Reduce Regulatory Risks

Put controls in place over content and templates with flexible business rules to adapt to different geographies.

“50% of affluent and high net worth clients think their primary wealth manager should improve their digital capabilities.”

─ McKinsey

CUSTOMER SPOTLIGHT:

Smart Communications Supports Service Excellence Strategy at St. James’s Place

A global 2000 financial institution, St. James’s Place in the U.K. offers investment, retirement advice and digital wealth management services. The company relies on the Conversation Cloud to simplify onboarding with integration to both Salesforce and DocuSign. By replacing paper and PDF forms, the company has accelerated turnaround time, reduced errors and made life easier for its advisor partners. With our Communicate capability, business users now manage document templates while advisors can rest easier knowing that their proposals are compliant with suitability regulations.

CLIENT SUCCESS STORIES

SMARTER Wealth Management Communications in Digital Wealth Management

Read 8 real-world examples illustrating how wealth management companies are working with Smart Communications to grow revenue and build loyalty, while reducing costs and compliance risks.

Download FlipbookDigital Wealth Management Software: See How It Improves the Client & Advisor Experience

Explore how the platform speeds up and simplifies all of your client conversations across the banking enterprise. See the power of our integrated capabilities working in harmony across multiple use case applications.

Reimagine Digital Wealth Management

Go deeper: Discover how these integrated capabilities work together in the Conversation Cloud platform.

Integrations to Maximize Your Technology Stack

The Conversation Cloud partners and integrates with many of today’s leading core systems, working together to help financial services institutions deliver best-in-class client experiences. This means you can extend and get more value from the technology investments you’ve already made. It’s purpose-built for tomorrow’s composable banking IT stack.

RESOURCES

More Resources for Wealth and Asset Management Firms

Learn more about how you can modernize your business, shifting to digital-first, two-way conversations with clients, financial advisors and other intermediaries.