The Ultimate Guide to Digital Forms Software provides an overview of this type of software, its capabilities, and benefits, addresses how it enhances the end-to-end customer experience, recommends questions to ask a digital forms vendor, and more.

2024 DIGITAL FORMS GUIDE: SOFTWARE & SOLUTIONS | SMART COMMUNICATIONS

The Ultimate Guide to Digital Forms Software

As customers’ expectations for simple, digital experiences increases, so must an enterprises’ ability to deliver. And as businesses explore ways to be faster, smarter and more innovative, one area that has been largely left untouched is digital forms management.

Across highly-regulated industries like insurance, financial services and healthcare—where customer interactions are critical and complex—the end-to-end experience should be seamless. While most businesses rely on paper-based processes or static PDFs, digital forms software allows companies to support more streamlined and secure online experiences.

While most businesses rely on paper-based processes or static PDFs, digital forms software allows companies to support more agile, secure online experiences.

What is Digital Forms Management Software?

In any enterprise, there is a need to gather information to serve customers and help simplify future interactions. This is on top of the demand for businesses to deliver faster outcomes and reduce the amount of effort it takes customers and employees to interact and complete a business process.

Digital forms software gives companies a way to collect information more accurately and efficiently, taking paper-based, manual processes and turning them into automated, intelligent interactions. Customers can seamlessly move from one device to another with the information they’ve entered following them along the way. The data collected can feed other technologies and core systems in real-time and can expedite decisions and determine next steps— reducing the amount of time it takes to complete processes and improving Customer Experience (CX).

Automating forms-based processes also has significant implications on internal business operations. Digital data collection removes the risk involved with manual, back-office processes. And, as companies invest time and resources in data strategies to protect customer information, modern digital forms software helps ensure compliance with internal and external regulations. Dynamic digital forms also ensure sensitive data remains within predefined tech boundaries regardless of whether an employee is in the office or working from home.

BLOG

Leverage Digital Forms Software to Enhance the Customer Experience and Improve Operational Efficiency

Read the Blog

Trends Driving the Need for Digital Forms Management

As enterprises try to identify areas that will benefit the most from digital optimization, data collection processes are often deprioritized because of the number of teams involved and the sense of “complexity” around their transformation. However, digitalizing these experiences from end-to-end can be quickly and easily achieved—and it is a quick and simple way to impact CX and help businesses meet their strategic automation goals.

There are several trends driving investment in digital forms software, including:

IT teams are tasked with identifying low-code, cloud technologies that easily integrate with other technologies and can be used by every line of business—not just IT.

By investing in low-code solutions, companies empower their employees by automating more processes faster. In fact, according to Adobe’s State of Work report, 32% of employees left their jobs because of poor technology, and 49% said they were likely to leave if bad tech got in their way.

And the benefits of cloud solutions speak for themselves, with no internal maintenance or building required. Ever. The increasingly advanced features that are needed to support regulated business processes are developed in anticipation of the changes coming.

Investing in the right technologies and letting business users own their core business processes allows IT teams to focus on large-scale initiatives and have a more meaningful impact within the organization.

Customers interact with businesses during some of the most sensitive, critical moments of their lives. Companies need to ensure every interaction brings them one step closer to an outcome. Extensive back-and-forth and multiple callbacks are unacceptable for customers and the employees engaging with them.

Features like real-time data validation and helper text ensure data is collected correctly and accurately the first go around, preventing delays downstream. Digital dashboards allow employees to see exactly where a request sits in a process—and rules can be applied to notify an employee if a request has been untouched for a certain amount of time.

These are just a few examples of how business processes can curate digital experiences to deliver fewer, more personalized, more impactful interactions that deliver outcomes in minutes or hours—not days or weeks.

Protecting customer data is important to every company and especially critical in highly regulated industries. As technology and regulatory requirements change, enterprises must comply and keep an increasing amount of data secure across multiple platforms and geographies.

By investing in a low-code, cloud-based digital forms solution, changes can be made and tested in minutes, not months. Collected data can be securely and seamlessly transferred to existing core systems or cloud storage platforms. Companies can ensure they meet the latest and highest security standards, including PCI DSS, SOC 1 and SOC 2, HIPAA, ISO/IEC, IRAP, FSQS, and VERACODE, among others.

REPORT

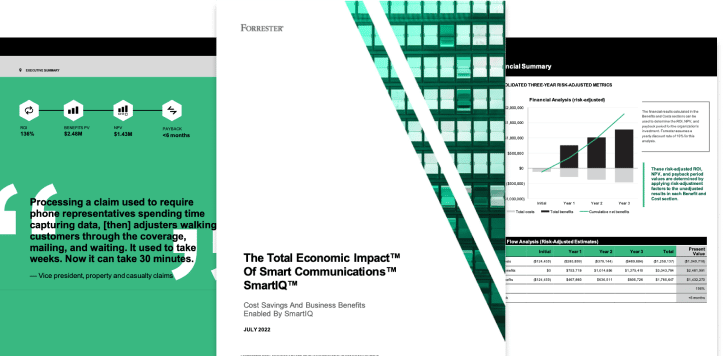

Forrester Consulting Total Economic Impact Explores the ROI of SmartIQ™

Key findings for the interviewed customer include reducing data capture cost by 70%, increasing NPS by 13 points an ROI of 136%.

Download to Learn MoreThe Benefits of Cloud-Based Forms

Throughout a customers’ lifecycle, there is always a need to gather information. Whether it’s during the initial acquisition phase, or servicing a longstanding customer, forms are a necessary part of the end-to-end experience. Unfortunately, these processes have been mainly excluded from the digital revolution of the last 10 years, and many companies are still offering impersonal and friction-filled customer experiences.

Nearly 60% of consumers are likely to abandon an interaction if a company has an inefficient process for collecting information

Source: Smart Communications

All too often, customers are asked to download and print a form. Or, they are tasked with filling out a static PDF, frequently re-entering previously known information or being asked to answer irrelevant questions.

And the headaches don’t end with the customer experience. The information customers provide has to be entered somehow, somewhere. Inefficient forms-based processes can lead to data quality and integrity issues – which in turn can lead to compliance issues, delays and lost revenue for enterprises.

Manual processes create friction for customers and employees

Fail to meet customers’ increasing desire for digital, mobile-first experiences

Inaccurate, inconsistent data collection creates delays downstream

Operational inefficiency stemming from a lack of centralization

High effort required for customers to complete a process

Unable to share or utilize collected information

Expedite business processes and deliver faster outcomes

End-to-end digital, mobile-first experiences and real-time status updates

Structured data intake eliminates delays and data cleanup

Use data integrations to maximize utilization of existing technologies

Gives business users ownership over critical business processes

Protects sensitive data

Improves data accuracy

EBOOK

5 Ways Forms are Ruining the CX and Hurting the Bottom Line

Enterprises still using paper-based forms are missing an opportunity to truly engage with their customers in meaningful ways.

Learn More

Enterprises that Benefit from Digital Forms Software

Across industries like insurance, financial services and healthcare, forms are a critical component of doing business. From new insurance claims and health plan enrollment to wealth management client onboarding and field underwriting, businesses rely on completed forms to run smoothly and deliver on customer expectations.

For these industries in particular, customer interactions are highly personal, sensitive and sometimes stressful. There is often no shortage of emotions, which is why it’s critical to create simpler and more efficient ways for customers to engage. Ultimately, this reduces stress and anxiety for the customer, while simultaneously optimizing internal processes.

Below, we highlight specific business processes that can benefit from digital forms and forms automation to deliver the seamless experiences customers expect.

Insurance

Financial Services

Healthcare

What to Look for in a Digital Forms Software Solution

Enterprises around the world are searching for innovative technologies that can securely help them modernize manual, outdated back-office processes—and reduce the amount of effort it takes to do business with them. When undergoing any sort of modernization effort, it’s important to identify processes that can be optimized in both the near and long term.

As part of this analysis, some important questions to ask include:

If you answered “yes” to any of the questions above, then you are ahead of the game! But, if you mostly answered “no,” then a forms transformation initiative should be in your future. So what are the important criteria to look for in a forms automation solution?

Below, we outline a few key features enterprises should look for in a solution:

- Low-code interface

- Response-based, mobile friendly experiences with full save and resume capabilities

- Automated data and approval workflows

- Pre-built connections to existing data sources

- Integrations with e-signature providers to simplify signing experiences

- Drag and drop interface

- Turnkey implementation

- Industry leading compliance and data protection

Integrating E-signature and Digital Forms

As enterprises automate more and more business processes, partnering with the right technology providers will be critical. And while automating multiple business processes at scale can feel like a tall order, technology integrations that focus on enhancing processes – versus tasks – will enable businesses to more quickly and efficiently deliver on customers’ expectations.

The e-signature experience, for example, is a process that could benefit from additional integrations. While many businesses believe e-signature alone is creating an amazing CX (although it is much more efficient than wet signatures, direct mail and/or faxes!), there is room for improvement. Through digital forms, forms automation and integrating the data collected via response-based interviews with e-signature solutions, the e-signing process becomes much more personalized – and fast.

Why Partner with Smart Communications for Forms Automation

The Smart Communications Conversation Cloud™ platform delivers personalized, omnichannel conversations across the entire customer experience. Its key capabilities – Collect, Communicate, Collaborate and Coordinate – are built on Integration and Intelligence layers, allowing enterprises to engage in SMARTER customer conversations.

SmartIQ™, a forms automation software within the Conversation Cloud, enables enterprises to modernize forms-based processes. In addition to guiding both internal stakeholders and end-users through automated, digital-first experiences, key benefits include:

How SmartIQ Works