- Collecting personal and financial data

- Conducting KYC/AML checks

- Opening accounts

- Capturing disclosures and signatures

Yet, for many firms, onboarding is still stuck in the past—dominated by manual processes like:

The Smart Communications Conversation Cloud is the only cloud platform delivering personalized, omnichannel conversations across the entire customer experience.

Explore the Platform

Explore how enterprises can leverage a cloud-based, CCM platform to optimize the end-to-end customer experience.

Learn More

We work with best-in-class technology and consulting companies to offer integrated solutions that complement our family of products.

Insights from 20+ partners and analysts on optimizing customer engagement in 2026.

An $84 trillion intergenerational wealth transfer is reshaping the industry—and with it, client expectations. Gen Y and Gen Z, raised on Uber, Amazon, and Apple, now expect digital-first engagement, personalized journeys, and real-time servicing from their wealth managers.

At the same time, firms face internal strain: shrinking margins due to FinTech competition, advisor retirements, and siloed systems slowing down operations. Traditional client onboarding—manual, paper-based, and error-prone—is no longer sustainable or competitive.

By automating data collection and workflows, wealth management firms accelerate time-to-value, reduce NIGO (Not in Good Order) rates, and enable scaling without adding headcount. This guide is your roadmap to reimagining client onboarding and servicing for the digital age.

“Nearly 70% of HNW clients say they would switch firms for a fully digital onboarding experience.”

Client onboarding is the process of converting a prospect into an active, invested client. It includes:

Yet, for many firms, onboarding is still stuck in the past—dominated by manual processes like:

This results in inconsistent experiences, long onboarding cycles, and high NIGO rates. Ultimately, these challenges put undue burden on the advisor and customer and can make for a bad first impression.

Wealth management firms today operate within a uniquely challenging intersection of pressures:

Firms must navigate a patchwork of global and regional regulations—Reg BI in the U.S., MiFID II in the EU, CCPA in California, and more. Globally, KYC and AML failures are among the leading causes of regulatory fines in financial services. Compliance cannot be an afterthought; it must be integrated into core workflows.

As firms scale internationally, they must also manage data across borders with sensitivity to local laws and client concerns around trust and transparency.

Clients expect digital access, real-time updates, and mobile-first servicing. Legacy tech stacks can’t deliver on these expectations without serious reengineering.

Yet in these challenges lie significant opportunities. Firms that modernize their onboarding and servicing models can not only improve efficiency but also position themselves as the preferred destination for the next-generation of wealth holders.

Client onboarding is more than paperwork—it’s a branding moment, a trust accelerator, and a competitive differentiator. And it’s often the first impression a client has with your firm.

In a world where nearly 70% of high net worth (HNW) clients say they would switch firms for a better digital experience, the onboarding process is often a test of whether a firm can meet client expectations.

The traditional approach—print, sign, scan, email—is riddled with friction. It also signals to clients that a firm is stuck in the past.

By contrast, forward-thinking firms are reimagining onboarding as an interactive, client-centric journey, characterized by:

This not only accelerates time-to-funding but also establishes the firm as digitally fluent and responsive—a key factor for younger and more tech-savvy clients.

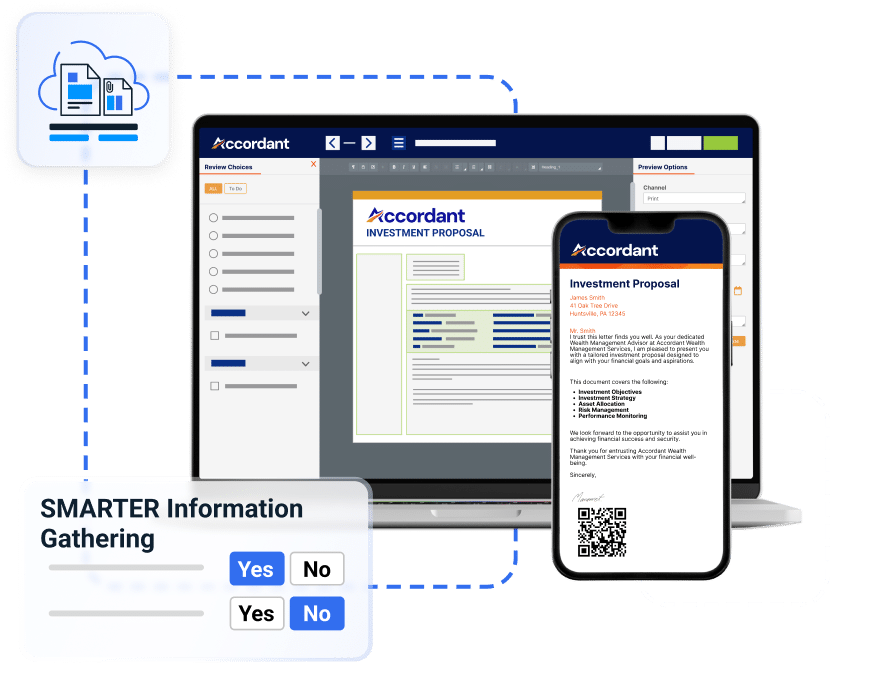

One of the most persistent bottlenecks in onboarding and servicing is manual data collection.

When client data is collected through emails, PDFs, or phone calls, it creates a host of downstream issues: duplicated effort, input errors, delays, and audit risks. Advisors and support staff spend time chasing details instead of building relationships or offering advice.

Modern firms are turning to automated data collection and customer data capture solutions that integrate directly with CRMs, trading and portfolio management systems, or internal databases. This allows for:

This approach not only reduces error rates and improves auditability, but also frees advisors to focus on high-value interactions while clients enjoy a smoother, faster experience.

If onboarding is the first impression, servicing is the long-term relationship. Yet for many wealth management firms, ongoing servicing remains fragmented, reactive, and overly manual. Common requests—like beneficiary changes, address updates, and KYC refreshes—still rely on email chains, downloadable forms, or even physical signatures. These inefficient processes create friction not only for clients, but for advisors and support staff who spend hours managing administrative tasks.

Next-generation clients expect the same fluidity from their financial institutions that they experience with consumer brands. They want to update information, review documents, or initiate requests at any time, from any device—without waiting on a call back or navigating paper-based workflows.

To meet these expectations, leading firms are embracing proactive, digital-first service models that:

Servicing is no longer an afterthought; it’s an ongoing opportunity to reinforce a firm’s value proposition. Each interaction—whether it’s a small address change or a more complex letter of authorization—is a touchpoint that signals how responsive, modern, and client-centric a firm really is.

Firms that invest in seamless, intelligent client servicing build loyalty, reduce overhead, free up advisor time, and improve internal consistency. In an environment where scale matters, effective client servicing is a strategic asset.

Many firms delay transformation due to a common fear: disrupting the existing tech stack. Legacy infrastructure—built for a different era—can be deeply entrenched, expensive to replace, and intertwined with existing workflows.

But transformation doesn’t have to mean wholesale replacement. The most successful firms are evolving their infrastructure incrementally and intelligently, layering modern capabilities on top of core systems to unlock agility without starting from scratch.

To support sustainable growth, onboarding and servicing infrastructure must be:

Modular – so new capabilities can be added without overhauling existing systems

Interoperable – with APIs that connect to CRMs, trading and portfolio management systems, compliance tools, and more

Secure and compliant by design – with full audit trails, role-based access, and regional data controls

Low-code or no-code enabled – allowing operations and business teams to adapt workflows without heavy IT intervention

Insight-driven – with built-in dashboards and analytics that surface process efficiencies and client drop-off points, enabling continuous optimization

Many firms attempt to modernize by layering tools like OCR, RPA, or form-fill platforms over existing workflows. While these can offer temporary relief, they rarely address root problems. They still depend on PDFs, manual handoffs, and static documents that lack context, logic, or auditability.

A truly scalable foundation for onboarding and servicing must be data-driven, workflow-oriented, and adaptive, enabling firms to deliver consistent experiences across clients, products, and geographies.

Digitizing onboarding and servicing processes is not just about efficiency—it’s about outcomes. To build internal momentum and secure long-term investment, firms need to clearly measure and communicate the value of digital transformation.

Reduction in NIGO (Not In Good Order) submissions – a critical KPI that directly impacts onboarding speed, client satisfaction, and back-office rework

Time saved per onboarding or service request – freeing advisors and support staff to focus on higher-value tasks

Speed-to-onboarding – a shorter time from initial engagement to full account readiness

Staff efficiency ratios – ability to onboard and service more clients without proportional increases in headcount

Compliance performance – better documentation, fewer exceptions, and improved audit readiness

Quantitative ROI is important, but qualitative impacts matter, too. Firms that invest in seamless onboarding and servicing report:

Higher advisor satisfaction due to reduced administrative burdens

Improved recruiting and retention of younger, tech-savvy talent

Stronger brand equity as digital experiences reinforce the firm’s modernity and professionalism

Increased agility in responding to new regulatory requirements or shifting client expectations

In short, modernization is more than just saving money. It’s about positioning the firm for resilience, differentiation, and growth in an increasingly competitive landscape.

For global and multiregional firms, one of the most pressing challenges is delivering a consistent client experience while respecting regional compliance requirements, language preferences, and cultural nuances.

Many firms today operate across jurisdictions where regulations vary widely. In the U.S., firms must comply with FINRA and SEC rules and regulations; in the EU, MiFID II and GDPR dominate. In APAC and the Middle East, other standards and preferences may apply—from ESG reporting to Shariah compliance.

A modern onboarding and servicing framework must be configurable at scale, enabling firms to:

This requires separation of logic from presentation so that regulatory rules, branding, and UX can evolve independently.

Managing regulatory complexity isn’t just a compliance exercise—it’s a client experience imperative. When clients feel they’re being asked irrelevant or redundant questions, or they’re bounced between channels or jurisdictions, trust erodes.

Firms that design global systems with localized intelligence not only reduce compliance risk—they elevate the entire onboarding and servicing journey to feel consistent, intuitive, and respectful of the client’s context.

The industry is evolving—and so are the expectations of clients, advisors, and regulators.

Wealth management firms that embrace a holistic, digital-first approach to onboarding and servicing will be best positioned to win client trust, streamline operations, and retain top talent in the years ahead.

Onboarding isn’t just a process—it’s a promise. It’s a firm’s first opportunity to demonstrate how it values its clients’ time, trust, and future.

Firms that lead with intelligent, client-centered design will not only meet this moment—but define what comes next.

© 2026 Smart Communications. All rights reserved.