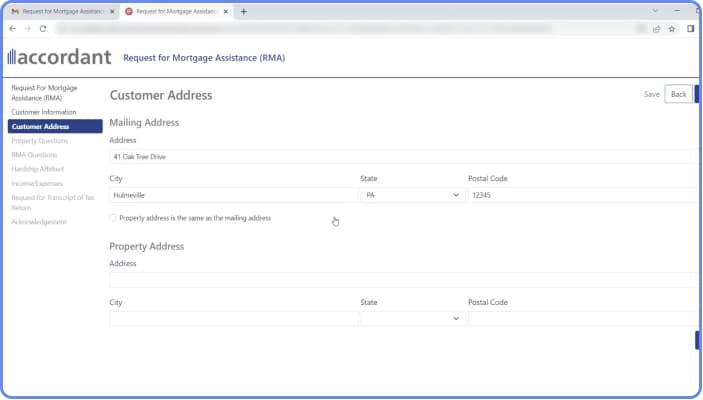

Eliminate fillable forms and guide borrowers through an online or mobile interview with SmartIQ™, connected to your systems of record. Enable digital document collaboration and negotiation for more complex loans. Produce personalized and compliant documents on demand, then route them seamlessly to your e-signature solution and document archiving system as needed, from loan approvals to adverse action letters.

Digital Lending and Credit Services Solutions

Grow revenue and loyalty by taking your digital lending programs to the next level, from consumer credit to commercial financing.

Request a DemoDeliver SMARTER Digital Lending Processes from Loan Origination to Credit Servicing

Borrowers today expect every interaction with lenders to be highly personalized, quick and easy. At the same time, lenders need to reduce costs and speed up turnaround time through digital automation. Learn how Smart Communications helps you deliver amazing digital lending experience – while getting faster and more efficient – with a single cloud platform designed to scale across your enterprise.

One Enterprise Customer Experience Platform for Every Lending Business Unit

Support all of your credit products, brands, languages and regions with a modern, SaaS-based platform designed for the digital world: The Conversation Cloud™.

Auto Financing & Leasing

Commercial Loans

Home Mortgage

Securities-Backed Lending

Credit Cards and Payment Plans

Credit Services Agencies

How Lenders and Credit Servicing Firms Achieve Real ROI with Smart Communications

Credit organizations around the world have chosen the Conversation Cloud platform to support digital lending transformation, delivering these business outcomes.

Fight off fintech competitors and close more business. When you treat borrowers like you know them, and make it easier to engage in the way they want, they’ll reward you with business today – and in the future.

Remove Friction Across Loan Origination Processes

Make loan origination faster and friendlier for borrowers with digital data capture and documentation processes, integrated with your core banking systems. Smart Communications enables you to speed up and simplify loan applications while delighting borrowers – making you the lender of choice.

The result? Fewer errors and digital lending packages delivered in minutes, not days, with less manual work by your staff.

Read MoreReduce Costs in Loan Servicing

With SmartIQ, improve digital self-service capabilities, reducing demand in the contact center and branch, while saving on print and postage. With SmartCOMM™, automate credit document generation processes at mass scale, and coordinate delivery across any output channel, from SMS to print. From billing statements produced at scale, to notifications and ad-hoc correspondence, rest easy knowing your communications are produced in the right language, brand and channel, in compliance.

Make Debt Collections and Recovery More Effective

Changing economic conditions have a huge impact on your customers – and your loan portfolio. Improve debt repayment rates by taking your collections communications to the next level.

Guide borrowers through debt resolution via digital channels – from mobile to desktop – and reduce demand for your contact center staff. Orchestrate delivery across digital and traditional channels. Optimize your communications so that content is both empathetic and effective, using built-in SmartCOMM analytics for readability and sentiment. Quickly update both forms processes and document templates to comply with financial industry regulators like CFPB, FCA, SEC and others.

PARTNER SOLUTION SPOTLIGHT

Automate Digital Lending Processes with Pega and Smart Communications

Need to collect information or generate documents and customer correspondence in a case management or customer service process? Learn how our solutions integrate seamlessly with Pega workflows, so you can engage borrowers and partners with personalized, compliant communications delivered in any output channel – on-demand or in batch. Our open APIs and pre-built accelerators make it easy to extend your Pega applications. From loan origination to servicing, organizations are reducing costs and improving digital lending process automation with Smart Communications and Pega.

Experience the Conversation Cloud

The Conversation Cloud is the platform for SMARTER conversations. It brings together a range of capabilities designed to guide customers, advisors and partners through critical banking and other financial interactions with your organization.

The Conversation Cloud Integrations Extend Your Digital Lending Technology Stack

Smart Communications integrates with many of today’s leading core platforms and software apps, working together to help your financial services institution deliver best-in-class client experiences. Use data to personalize every borrower engagement, from prefilling digital interviews with CRM data – to e-signature – to coordinating digital delivery and automatic archiving. All of this supports what you need today – and future proofs your digital lending strategy for tomorrow.

The Bancorp Digitally Transforms Loan Origination with SmartIQ and DocuSign

"Our loan closing package combines about 100 different documentary artifacts into about 350 possible combinations. This is a significant task. We can do this in a fast and easy way with SmartIQ.

What makes SmartIQ stand out is ease of implementation, ease of maintenance and ease of enhancements."

- Jeffrey Hazelwood, Managing Director,

Institutional Banking, The Bancorp

Ready to Bring Digital Transformation to Your Lending Operations?

Take a deeper dive into ways Smart Communications is helping lenders to deliver a better experience for borrowers, while reducing cost and risk.

THOUGHT LEADERSHIP

6 Ways to Change the Lending Conversation

This eBook provides actionable strategies and tips to help you re-imagine the way you interact with borrowers and loan officers in the digital-first world.

Download eBook

Ready to Transform Your Digital Lending Capabilities with SMARTER Conversations?

Let’s talk about how to grow your loan business and optimize the borrower experience, while reducing risk, with industry’s leading cloud-based platform for enterprise customer communications management.

Contact Us